Supply Chain Management and Logistics Blog. Posts are about end-to-end supply chain management and logistics in a time of challenging disruption. Tom provides leading supply chain management and logistics consulting and advisory assistance based on real-world experience. He brings authority and domain expertise to clients. Email Tom at: tomc@ltdmgmt.com Check Tom's profile at: https://www.linkedin.com/in/tomcraig1/

Saturday, October 27, 2018

MULTI-LEVEL WAREHOUSING, SUPPLY CHAIN VELOCITY, LEAN WASTE

Riddle me. Are multi-level distribution / warehouses and their restocking & replenishment an impediment to Supply Chain Velocity? Are they a source of waste for Lean SCM?

Friday, October 26, 2018

CMA CGM TO ACQUIRE CEVA LOGISTICS

Escalation of a Maersk-CMA CGM battle to be end-to-end logistics players. What will it mean to the traditional providers?

https://splash247.com/cma-cgm-moves-to-acquire-ceva-logistics/

Thursday, October 25, 2018

FUTURE OF RETAIL?

Which is the future for retail, besides e-commerce, do people come to the stores or do the stores come to people with Virtual Reality and other technology? Technology would also increase the need for Supply Chain Velocity that is required for online.

CHALLENGES OF ONLINE RETAIL EXECUTION

Why do retailers still struggle with omnichannel SCM? Instead of Supply Chain transformation, have they looked for easy answers in a complex matter? Supply Chain Management is now strategic.

HRC Retail Advisory Survey Reveals Challenges of Online Retail Execution

The survey revealed the friction points retailers face in offering an omnichannel experience to consumers.

By Arthur Zaczkiewicz on October 25, 2018

Online shopping is driving demand for faster delivery service.

Shutterstock / Maxim Minaev

In a survey of top retail executives by HRC Retail Advisory, the “rush to deliver omnichannel offerings” has created “operational challenges” that are souring the shopping experience for consumers.

All of the respondents in the survey, which polled 30 C-level executives of leading North American retailers with a median sales volume of $2.6 billion, noted that they are having operational challenges as a result of implementing and delivering an omnichannel approach.

Antony Karabus, chief executive officer of HRC Retail Advisory, said brick-and-mortar retailers “have overextended themselves as they’ve tried to leverage their physical store fleets.”

ADVERTISING

“E-commerce and omnichannel fulfillment and related returns have led to sharply rising freight costs and product margin challenges,” Karabus explained. “Meanwhile, consumers expect ever-faster delivery, pressuring retailers to meet those expectations in order to remain competitive. Very few retailers have formal scorecards to measure the performance and profitability of their omnichannel efforts, which often means they can’t effectively and efficiently take the corrective action needed to improve customer service and profitability.”

Antony Karabus

Courtesy image.

Researchers at the firm found that BOPIS (buy online, pick up in-store) “is not consistently reliable, as systems often tell shoppers that an item is available in a specific store when the store does not actually have it in stock.” The poll found that 66 percent of retailers surveyed said BOPIS execution is “inconsistent due to retailer inventory inaccuracies.”

The survey also found that just 14 percent of respondents “are using predictive analytics, and most of these retailers are struggling to figure out how to integrate such analytics into operational processes.”

Karabus noted in the report that as the industry navigates the convergence of online and physical stores, “as well as customers’ increasing demand for ordering, picking up and returning their products whenever and wherever they desire, retailers must now offer omnichannel services as a standard in order to compete effectively and leverage the advantages their physical stores give them over e-commerce-only retailers.”

Other notable findings of the report include the revelation that inefficiencies in fulfilling online orders are causing delays, “as 77 percent of retailers ship primarily from e-commerce fulfillment centers instead of from local stores that may be closer to customers’ homes or offices and thus allow customers to receive their orders quicker,” authors of the report said.

Additionally, nearly 70 percent of the retail executives polled are “not optimizing their customer order systems to prioritize filling the entire order from one location, causing split shipments and increasing freight costs.”

Karabus said that the biggest challenge overall facing today’s retail leaders “is identifying which is the most cost-effective location to ship e-commerce orders from and how to allocate merchandise to stores based on consumer demand, one has yet to be figured out.”

https://wwd.com/business-news/business-features/hrc-report-1202891911/

Monday, October 22, 2018

E2OPEN TO BUY INTTRA

What does it mean to the technology part (process and organization are the other parts) of Supply Chain Structure? Will it increase disintermediation within forwarder and other logistics niches? SCM

https://www.wsj.com/articles/software-provider-e2open-buys-shipping-platform-inttra-1540202401?mod=djemlogistics_h

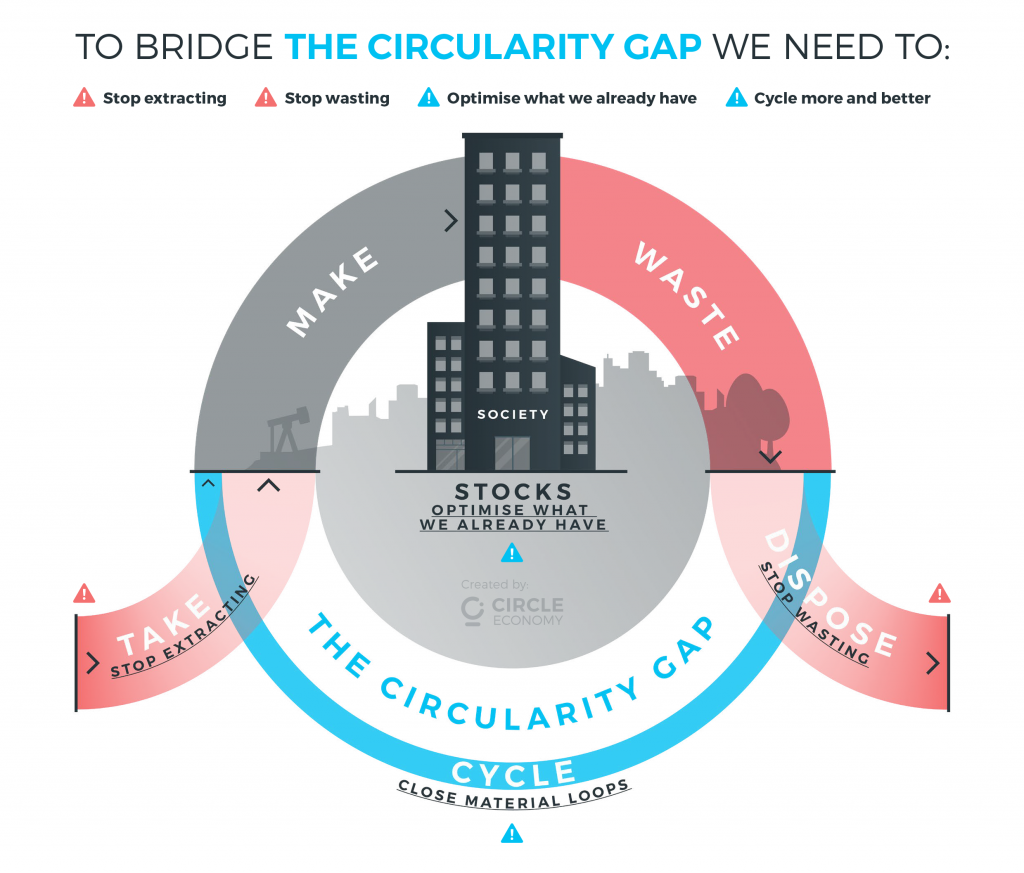

THE CIRCULAR ECONOMY, SUSTAINABILITY, SUPPLY CHAINS

Why the circular economy must link up the whole supply chain

Maersk, whose flagship MV Maersk Mc-Kinney Moller is pictured, has begun creating ‘digital twins’ of its latest container ships to assess the use of the materials involved.

Image: REUTERS/Renata Dabrowska/Agencja Gazeta

20 Sep 2018

- Daniel SchmidChief sustainability officer, SAP SE

- Will RitzrauDirector of sustainability, SAP SE

Finally, the long-discussed concept of the circular economy (CE) seems ready for takeoff. More and more observers see new information technologies like the internet of things (IoT), big data analytics or blockchain as the powerful means everybody is waiting for.

And yes, its promises are truly thrilling. Yet the real door-opener is still to be found in the analog world: It’s about trustful collaboration. Doesn´t sound too sexy, does it? We know. But only when all actors along the product life cycle find profitable ways to take resource scarcity into account, and only if they share both costs and benefits, will CE be able to unfold its full potential.

So trustful collaboration is asking for a lot. It needs to convince decision-makers of the business opportunities they get once they trade their silo-oriented optimization rationale for a holistic-management approach that addresses the entire life cycle of the products and the materials involved.

Sure, the road is still long. While not yet being comprehensive enough, the first brilliant examples of circular approaches show the way forward. And it is not only about consumer market visionaries like Ray Anderson of Interface, or Yvon Chouinard of Patagonia. Making use of circular economy to prosper and differentiate products and services is suitable for business-to-business heavyweights, too. For example, ocean carrier Maersk created a digital twin of their latest container ships down to the smallest bolt. Through this, the company will ultimately know how much and what material is being used in their fleet. During routine overhauls or at the final disassembly, Maersk has a clear systemic view on which parts and materials can be reused, remanufactured, upcycled or continue to stay in the circular flow of shipbuilding. This is similar to Caterpillar, whose remanufacturing business takes back more than 150 million pounds of material from customers per year. According to a survey by The Conference Board, Caterpillar’s portfolio of sustainable products and services generates almost one-fifth of company’s total sales and revenues.

Executing supply chain power

It's not by chance that most CE case studies are when economically strong asset owners and service providers such as Caterpillar and Maersk are in the driving seat. The same applies to powerful vendors, for instance tech giants such as HP and Dell who have established highly efficient return systems for used products. Why is it that CE pioneers are often found among these kind of companies? The two most obvious reasons: on one hand, these players have understood the value of the materials involved to such an extent that they decided to take on responsibility for them. On the other, they have the business acumen to guide and influence the use phase of a product.

Albeit, all of these cases studies are rather short value chains. CE examples covering entire chains are still yet to be found, which is no surprise at all – implementing comprehensive cradle-to-cradle scenarios is one of the biggest challenges facing supply chain managers. The degree of difficulty can be seen in the chemicals industry. Here a lot of companies have already gained deep expertise in extending the reach of sustainability management to the production level; for example, the “Production Verbund” of BASF, a role model for efficient and inter-connected material and energy flow in chemical production. However, compared to big asset owners, service providers or responsible vendors, the power of the process industry to convince value chain partners to participate joint CE strategies is much more limited. Chemical companies work upstream as a tier-one value creator after the extractive industries. Since most partners are downstream, laying out a CE scenario is like pushing a rope.

The scope of true sustainability

However, both downstream and upstream, the headwind in favour of CE is blowing strong. Still, most companies optimize their operations and products within their own narrow sphere of influence. Even the current most progressive perspectives towards sustainability are not yet broad enough. In his recent blog on MIT Sloan, Toronto-based professor Cory Searcy explains why: “Corporate sustainability is often framed using the triple bottom line (TBL) of economic, environmental and social performance. But the TBL does not connect company performance to the economic, environmental, and social resources on which they rely. Performance is assessed relative to the company itself or its peers, rather than against thresholds linked to those resources. This makes it impossible to assess true sustainability.”

To overcome this deficiency, Searcy calls for an embedded view that makes explicit connections between a company’s performance and its place in society, which itself exists within the natural environment. With this in mind, sustainable businesses must operate within economic, environmental, and social thresholds. To make this concept work, reference thresholds and targets, such as the planetary boundaries and the Sustainable Development Goals (SDGs), need to be translated into tangible business actions. The Science Based Targets initiative illustrates how this can be done, by focusing on greenhouse gas emissions. Another example is the UN Global Compact’s CEO Water Mandate, which advances water stewardship and sanitation.

Operating within the planet's limits

So what does this all mean with regards to CE? First of all, every constituent of a specific value chain needs to understand that the chain as a whole will lose, once an indispensable resource is gone. This can be in its own production, or in someone else´s. Thus the chain, too, must take into account the planetary limitations. Like each and every one of its constituents, the supply chain needs to operate within economic, environmental and social thresholds. Supply chain managers have to develop metrics that take the sustainability context into account, as well as building relationships with players across the entire chain.

The concept only works if supply chain partners build up mutual trust in the sustainability information each partner is giving. Therefore, CE requires transparency about associated materials and financial flows of the product and its components during their entire life cycles. A bold example of this thinking was the environmental profit and loss analysis Puma published already in 2011.

The required transparency can easily be provided by the newest information technology of connected devices, big data analysis, cloud computing, or distributed ledger technology (aka blockchain). Coupled with IoT tracking and AI-enabled global data matching models, these are necessary ingredients to bridge the physical gap along individual processes in supply chains during a product’s use phase and at end-of-life.

Russian startup INS provides a disruptive example of what is possible with its platform connecting grocery manufacturers and consumers. One of the key benefits will be to minimize food waste caused by the deficiencies of push-oriented retail systems.

Connecting the dots to the whole value chain

The crucial IT foundation is in place. Most companies run modern enterprise resource-planning systems to synchronize material and financial flows. This enables and supports decision-making and optimization within an individual organization. The information is available, but the dots need still to be connected. Supply chain managers need to extend the focus of data analysis to the whole value chain. Only then they will get the right information to help both themselves and their supply chain partners harvesting the multiple benefits of a CE.

The business cases of a circular life cycle are dependent on finite resources and must consider all value creation from the production, use, end-of-use to the recycling phase. Recent developments to transform business models from selling products to providing services offer the opportunity to establish circular models, as shown by Interface, Maersk or Caterpillar. In any case, a wider understanding and ownership of the life cycle of a product is required.

Have you read?

Here, advanced management education comes into play. Innovative holistic education curricula will provide the required intellectual ingenuity, creativity and mindset to transform organizations towards sustainable and long-term viable businesses. Without considering the bigger picture of the planetary boundaries, all constituents of individual or specific value chains will lose in the end once a resource is gone. Information technology can create the required transparency on flows and availability of materials and the associated financial costs. This elevated transparency will become the foundation of fact-based trust – making CE the most profitable business model of the 21st century.

Wednesday, October 17, 2018

MANUFACTURING AND PERFECT ORDER MEASURE

The Perfect Order may be the best corporate, Supply Chain, and customer service performance metric. Orders delivered complete, accurate, and on time. Why don't more manufacturers use it?

Tuesday, October 16, 2018

MAERSK AND SUPPLY CHAIN MANAGEMENT

Maersk wants to be a player with the end-to-end supply chain. This may be the third or fourth time for this going back to Mercantile. What will be done differently to blend logistics & Supply Chain requirements of customers into a successful model and business?

Friday, October 12, 2018

INVENTORY--ASSET OR WASTE?

To finance/accounting, inventory, even extra inventory, is an asset. In lean Supply Chain Management, it is a waste. SCM

Monday, October 8, 2018

UNDERSTANDING SUPPLY CHAIN COMPLEXITY

Article--UNDERSTANDING SUPPLY CHAIN COMPLEXITY

--For Lower Costs, Increased Velocity, & Improved Performance--

- 9

- 0

-

1

Supply chains for retailers and manufacturers are under pressure to reduce costs AND improve performance. The low-hanging fruit has been picked. It requires new ways. It starts with recognizing and addressing supply chain complexity.

End-to-end supply chain management, especially ones with international segments--nothing in business is more complex. This is not hyperbole. It is fact. And it must be understood to manage the supply chain because complexity can be a barrier to achieving needed supply chain velocity that is so important in the expanding omnichannel.

Manufacturers and retailers are in a period of disruption. Velocity is required. Supply chain velocity. Inventory velocity. Order-delivery velocity. A problem with achieving these is that companies, regardless of their age, are using a supply chain template that is 20+-years old with emphasis on logistics costs and not on velocity.

There are obvious ways to see the end-to-end intricacy. These are length and time. Supply chains with international souring and/or export sales are long. That length means the time to move products through the supply chain.

Time is a multi-occurring issue. There are times to deliver perfect orders; to meet production schedules; time for this and time for that. It is a common supply chain topic. But there is more.

Inventory is impacted by the time from a product is needed to be replenished from the supplier until it is restocked in warehouses. Longer time adds uncertainty and requires more inventory to be carried as a buffer and more working capital to cushion sales or incur stockouts and lost sales. Companies can become inventory rich. The excess working capital is funds not available in other areas of the business, including transforming the supply chain to compete in the new selling reality of omnichannel and e-commerce for both B2C and B2B.

Additional recognition must be given as to:

· Participants. No group in an organization has more participants and players than supply chain management. This includes both inside and outside the company. Supply chain management crosses the company and interacts with almost every department in a company. As for external, the supply chain extends both directions—toward suppliers and customers. For example, an international supply chain could have 15 or more players with each order and shipment.

· Upstream. Much attention is paid to the downstream supply chain with distribution centers, stores, and factories. The weakness here is that the supply of supply chains begins upstream. Upstream has been often overlooked except for the emphasis with sourcing and with purchasing and inbound freight costs.

· Non-linearity/Supply chains within supply chains. The straight-line supply chain is an illusion. It ties to the "agile", one-size fits all view. Every firm has a supply chain—and more. Think of the Mississippi River in the US. IT is very long, runs from Minnesota down through Louisiana and into the Gulf of Mexico. But the river is not a single entity. It is fed by 7,000 streams, water basins, and smaller rivers. These smaller bodies of water flow through 31 states and 2 Canadian provinces. The great river is not a single entity. Neither is the supply chain. That is how supply chains are—many branches of inventories and activities—and how they evolved.

· Horizontal process. It flows across a vertical organization. The directional conflict between supply chain management and the company structure is more than a silo matter. It creates delays and impacts the process both inside the particular company and with suppliers and customers as it extends upstream and downstream. Plus, those suppliers and customers have a similar flow challenge.

There is a multiplier effect with multivariant elements. Namely, the more the components, the more the complexity—and the challenge to achieving critical supply chain performance success. That is an underlying factor with supply chain management.

The greater the end-to-end supply chain complexity, the:

1) Increased supply chain risk.

2) More inherent lean waste.

3) Challenge to control.

4) Greater likelihood that supply chains processes are under-designed and under-managed.

Understanding complexity is the first step. Addressing it is important for achieving supply chain velocity and its inventory and order delivery velocities. This is especially so with manufacturers and retailers achieving needed supply chain speed that are still using essentially monolithic supply chains. These are not agile and lack supply chain duality in the new omnichannel reality.

The new way to lower costs, increase velocity, and improve performance is to:

1) Attack the complexity. This can create significant improvements.

2) Move upstream. Go to where supply chains begin. Think of it. Many downstream problems start upstream. By the time they get downstream, the problems are compounded as to affect. A caution, the upstream has much of the supply chains within supply chains and nonlinear parts.

3) Assess. Identify. Segment. Prioritize. Focus where the needs and financial returns are greater. Remove bottlenecks and flow delimiters.

4) Evaluate the players and participants--both external and internal, their roles, and value. Reduce where possible. Integrate to reduce process gaps and blind spots in technology.

5) Compress time. With time and its lean international waste impact, this is important. Value stream mapping is a viable tool to use here.

The demands for greater velocity will increase. Think Velocity2—velocity squared. The longer it takes to start, the further behind firms fall in catching up.

Subscribe to:

Comments (Atom)