When a brittle supply chain snaps, customers don’t get their products, companies lose revenue, brands are sullied, and the company suffers.

As CFOs, we wear a lot of hats. We oversee the treasury, monitor our markets and position our companies for the future. Let me suggest another hat we should be wearing: that of the champion of supply chain resilience.

Jeffrey Burchill, CFO, FM Global

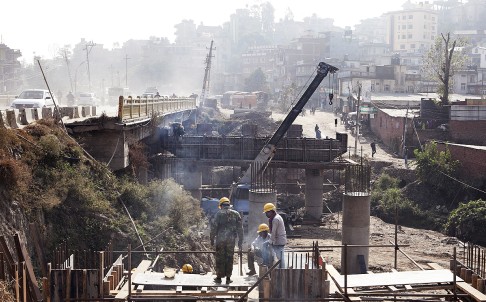

This role entails taking a hard look at the vulnerabilities many companies have lurking in their supply chains. Manufacturers retain supply chain partners all over the world to take advantage of affordable labor, key customer clusters, and access to raw materials. This globalization, however, has made the typical company’s supply chain more complex and distributed than ever, leading to potentially greater vulnerabilities.

Careful management of such complexity often yields the best business results. Supply chain executives are lauded for driving out costs, making supply chains “lean,” and achieving

just-in-time delivery.

Streamlining a supply chain, however, can be a gamble. The same efficiency that keeps costs down often creates vulnerability. And when a brittle supply chain snaps, customers don’t get their products, companies lose revenue, brands are sullied, and the company suffers.

Further, I worry a lot about the multiplier effect such disruption can cause for the companies my employer insures. A company can be running its own plants close to perfectly but can be severely crippled by the lapses of its suppliers. Although it’s not easy for a CFO to convince his or her company to probe the resilience of key suppliers, it absolutely needs to be done.

Our chip manufacturing clients, for example, are happy to have our semiconductor specialists visit their suppliers and assess them against the loss-prevention criteria we’ve developed for semiconductor fabrication facilities. In fact, we spent three days a few years ago looking at one of the world’s top-three chip foundries. We found some safety issues, which the supplier took care of quickly or at least budgeted for. The visit also gave us more information about our clients’ supply chain to help them better understand their risks and plan for contingencies.

The pharmaceutical sector is particularly sensitive to supply chain disruption. Pharmaceutical and medical products must pass numerous quality and safety tests and product trials that often take years. So when a drug finally hits the market, the manufacturer has to quickly recover its research and development costs and can’t afford a business interruption or a loss in revenue.

Moreover, any loss of a key supplier can take up to 18 months to replace because of the complex and heavy businesses and regulatory processes involved. Concerns like these resonate with all our clients in pharma and beyond. If finance chiefs aren’t investigating the vulnerabilities in their supply chain, they’re taking a big gamble.

The Risks Are Wide and Deep

In fact, supply chain vulnerabilities are quite common. Four out of five of 525 business continuity, supply chain, and other professionals based in 71 countries who responded to the

Business Continuity Institute’s (BCI’s) Supply Chain Resilience 2014 survey reported that their companies experienced at least one instance of supply chain disruption in the past 12 months.Adverse weather, IT outages, and outsourced-service failure were common sources of disruption.

The risks indeed run deep. For example, sometimes it’s not one’s immediate suppliers that disrupt a supply chain but the suppliers of those suppliers . More than half of the respondents in the BCI study indicated that the disruptions of the past year had come from suppliers below the top tier.

Perhaps more pertinently to finance executives,

an Accenture study has shown that supply chain disruptions can reduce shareholder value in affected companies by 7%.

Perhaps unaware of that weight financial risk to their companies, many CFOs completely delegate

supply chain risk management to a risk manager or supply chain manager. In my opinion, it’s beneficial for finance folks to drill more deeply into what these managers know about supply chain risks.

Here are some questions to ask them on a quarterly basis:

• What don’t we know about our supply chain that we need to know?

• Are we relying too heavily on single suppliers for important components?

• Are we focused too heavily on cost reduction, making our supply chain brittle?

• What could a closer look at our analytics tell us about these and other hidden risks?

• What exactly are the other risks we might be facing?

• Which particular risks are most insidious?

These questions are answerable no matter how complex or far-flung one’s supply chain.

Another approach to managing risk is a formal supplier impact analysis. Consider appointing or hiring a team to analyze the value of each link in the supply chain in terms of its contribution to business income.

At the same time, it’s a good idea to flip your perspective and look at the people you supply: your customers. Do you need to diversify so you don’t end up sitting on supply if a major customer experiences a disruption?

Yes, it’s a lot to do. But whether you use these approaches or ones you devise yourself, a long-overdue investigation will help you better uncover, quantify, and manage your supply chain risk. As champion of supply chain resilience, you’ll be safeguarding your company from a crippling disruption and eliminating the kinds of surprises we CFOs dread most: the ones we might have foreseen.