Agility reveals plan for logistics arm to become a tech company 'that does freight'

By Alex Lennane

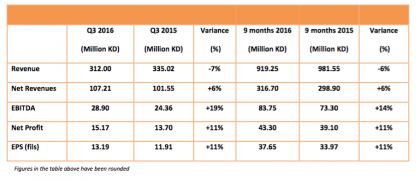

Agility reported a solid set of results for the third quarter, which despite revenue declines of 7%, saw net profit grow 11% to KD15.17m ($50m).CEO Tarek Sultan acknowledged “sluggish economic and trade growth in key regions” and “political uncertainty” in others.

While the infrastructure arm contributed most to group profitability, Mr Sultan added that the turnaround of Global Integrated Logistics (GIL) was progressing well.

GIL saw revenues decline 8% to KD228.65m ($753.5m) in the third quarter, but it saw growing demand for contract logistics and a “strong performance” in ocean freight, both in volume and yield.

Air freight grew in volume, but yields were down, resulting in flat net revenue, while its project logistics business suffered from the slowdown in oil and gas.

But GIL has a strong vision for its future, according to CEO Essa Al-Saleh, and sees itself as a technology company which does freight, he told The Loadstar.

“We see five elements which are important to our customers: reporting; rate calculations; analytics; IT interfaces; and the physical movement of freight. Four of those are technology-related.

“We need the ability to develop and deploy systems and mine data in a manner that suits our customers. Big data is the basis of our technology development – we are investing a lot in this.”

Agility has looked at both outsourcing its tech needs, and developing it in-house, and has opted for the latter.

“We are called Agility – we need our own skills. We may buy bits and pieces from the outside, but the core will be ours,” said Mr Al-Saleh. “We have a tremendous amount of big data analytics, and that is a huge enabler for customer development.

“The customer understands the physical side, but we can provide insight through our data. Shippers have become much more knowledgeable about our industry and that’s a healthy situation. They are more able to demand solutions.”

While in-sourced IT solutions have not always been the best option for companies in the past (see DHL’s NFE disaster), Mr Al-Saleh said it was equally important to enable staff to understand the processes.

“We are developing an IT mindset – you have to bring your people along. You have to engage, develop, empower. You can do as much as you want on the technology side, but if you don’t bring people with you, you’ll fail.”

And development never ends, he said. “It’s an essential focus for us to remain relevant. The pace is moving very fast. You can’t just launch an app and be done, you need to continually improve.”

He dismissed fears from some in the industry that technology – and transparency – might reduce the value and margins of a forwarder.

“We are in a commodity business – let’s embrace that. Then you are focused on being efficient – and that’s important. It’s not like before. Yes, transparency has an impact on margins, but you have to continuously improve and get fit. You don’t want to be in the comfort zone.”

Agility’s staff certainly aren’t. Under Mr Al-Saleh, Agility has introduced minor cost-saving measures with major impact on results – such as no business class travel for anyone, including Mr Al-Saleh, unsurprisingly resulting in fewer flights booked overall.

Mr Al-Saleh believes every company needs to be fit and sustainable – and it was not the fault of its customers paying too little that Hanjin failed.

“Every industry goes through some change. You can’t be subsidised to survive. We are not in it to sustain a company. If you look at the last few months of Hanjin’s operations, its rates were among the lowest. You need healthy players. You have to be fit and lean in a commodity business.”

He said Agility had set up teams of experts to watch the shipping line landscape and mitigate risk of further disruption to customers from another bankruptcy.

“But volatility is always there – and that’s why the freight forwarding industry will always be relevant,” he added.

*Agility’s net profit was KD15.17m, an 11% increase from KD13m in Q3 2015. EPS stands at 13.19 fils, compared to 11.91 fils in Q3 2015.

*EBITDA is KD28.9m, a 19% increase.

*Agility’s revenues for Q3 2016 were KD312m, a decrease of 7% year-on-year.

*Agility’s net revenues increased by 6%.

*GIL’s revenue is KD228.65m, a decrease of 8% y-o-y (6% decrease on a constant currency basis).

* Infrastructure’s revenue is KD85.91m compared with KD88.64m in Q3 2015.

*Agility had a net debt position of KD50.63m and KD4.60 m of free cash flow at the close of the quarter.

No comments:

Post a Comment