ANALYSIS - Can CEVA's turnaround plan work in time to save it from debt deadline?

On the one hand, its recently released 2015 annual results showed that the ailing logistics behemoth has reversed the trend of rapidly widening losses the year before.

On the other, however, its capital structure remains highly problematic and the clock is ticking on cash flow generation and debt repayments.

According to my calculations, its daily cash-burn rate is $175,300 above break-even once all its costs – including heavy investment, interests and taxes – are considered.

It is fair to say that things are improving – its cash-burn rate was a whopping $613,000 a day in calendar year 2014.

But CEVA was still in the red to the tune of $210m last year, and although that represents a substantial surge from the $393m loss in the prior year, in 2014 the length of its debt maturity profile was much more reassuring.

The sword of Damocles

“On 19 March 2014, the company announced that it successfully completed the March 2014 refinancing,” CEVA reiterated in its latest annual results.

“Through these transactions, CEVA further increased capital available to fund growth initiatives and established a long-term capital structure with a weighted average period to maturity of 6.3 years.

“As at 31 December 2015 the weighted average period to maturity was 4.6 years.”

How time flies… and CEVA is still burning over $5m a month, mostly due to its bloated operating cost base. So, there are two ways to deal with the problem, in my view, before the next big debt repayments come due in 2018 – either a cash call ensues or thousands of jobs will have to be chopped.

If its balance sheet were recapitalised today and all its debts paid off, cancelling some $167m of combined interest and other financing costs, I estimate that CEVA could easily churn out over half a million a day in core cash flows.

The allure of capital arbitrage appears obvious for trade buyers, who could be tempted to bid up for the assets and use cheaper funding to finance the operations, but… the reality is that would-be suitors live in the knowledge that the logistics industry might get worse before it gets any better, with very little organic growth in sight, if any at all.

And for its part, its owner, private equity house Apollo, is not going to write a cheque to recapitalise the balance sheet of a company that has been stuck on its books for about a decade.

In fact, Apollo “wants to get out” as soon as this year, we have recently learned. I was unsurprised to hear that, but I think it could be a rather long wait, unless CEVA can be acquired for a hard bargain.

If virtually all the debt of CEVA was replaced with new equity today, the company would get closer to reporting economic profits in 2016 and beyond, making it would be a much easier sell. The odds are long, however, that Apollo would bite that bullet and further diluting its overall return on the CEVA investment, especially at a time when rising gross debts at over $2bn remain the biggest headache.

And that is why, speculation aside, it may take over a year before a convincing offer emerges either for the group as a whole or for its freight management and contract logistics units.

Headwinds

A few headwinds persist even though its operations are slowly getting more traction than in the past.

It said that the 2015 full-year results “demonstrate strength of (the) operating model”, but there remain doubts this corporate story may have a happy ending given the weakness in the capital structure.

Not only is CEVA at the mercy of the business cycle; cash flows are slowly improving, but net debt at $1.8bn rose once again in 2015, putting its adjusted net leverage in the region of 7x, up to 9x on an unadjusted basis.

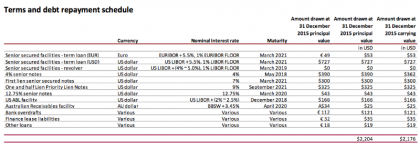

Its full debt repayment schedule is shown in the table below:

In 2015, it paid back $510m of debt, mostly using $467m of proceeds from existing borrowings, its cash flow from financing shows.

CEVA has some time to get its own house in order, yet by when the next big debt deadline comes due, it will have to have generated enough cash to pay its lenders.

The problem is that the group is faced with obvious currency headwinds, which will continue to put pressure on reported revenues, which were down 11.5% year-on-year, well into mid-2017, and that is also implicit in the level at which the Dollar Index trades, and is supported by the likelihood of more dovish than hawkish monetary policies at the Federal Reserve.

Unfavourable exogenous trends combine with an operating cost base that is hardy tenable, as I argued a year ago – its staff-related costs are simply too high at this critical economic juncture.

Free cash flow sought

As at 31 December 2015, CEVA had $309m (31 December 2014: $386m) of cash on its balance sheet.

“With undrawn central facilities of $267m available at 31 December 2015, the group therefore had headroom of $576m at 31 December 2015 (31 December 2014: $656m) to fund operating activities for the foreseeable future.”

Well, its available cash balances now amount almost exactly to the principal it has to repay in the first half of 2018 – and its core free cash flow could still be negative to between -$50m and -$150m this year, before certain adjustments are made, while reaching break-even only in 2017.

Despite serious efforts aimed at managing its short-term liquidity, which shows in its net working capital, it just hit $27m of operating cash flow in 2015 but is investing more than in the past, with capex at $90m for the year.

So, certain signs are mildly encouraging. The majority of its debts are due in 2021, which is hardly around the corner, but I don’t think CEVA will exist in its current form by the end of 2017 – even under the most bullish two-year scenarios for revenue growth and Ebitda margin, which is rising, the next 24 months could end up being the defining period in its short but colourful history.

No comments:

Post a Comment