ANALYSIS: Despite strong quarterly numbers, the spectre of competing with Amazon looms large over FedEx

© Ken Wolter

The usual quarterly call with analysts that followed the announcement unequivocally proves that the war of words between express operators and Amazon has just started. This is now a story of words, headline and disruption risks rather than numbers.

FedEx is delivering across all its business units, its key adjusted financial figures showed on 16 March, but the fly in the ointment seems to be a lack of appreciation of just how much Amazon could seriously disrupt the entire supply chain and the transport industry at some point – a point that has now arrived in France, for instance.

Quite simply, managing disruption risk is critical for FedEx and its peers because such a huge and unpredictable potential competitor such as Amazon – which has different capital requirements from the incumbents – could well be up for a fight.

War of the Words

The jury is still out of course, but in the wake of the Amazon/ATSG deal it is increasingly valid to question whether the management team of FedEx – one of most respected in the logistics industry – has lost touch with reality.

This has been a recurring debate in analyst forums since FedEx management made some pretty astonishing remarks followingon the day its quarterly results were announced.

When asked how serious the threat posed by Amazon was for FedEx, executive vice president Mike Glenn pointed out that “it is very clear that e-commerce has now enabled a full scale retail revolution”, but he ruled out Amazon – a firm that has disrupted the entire retail and cloud computing services industries in less than 10 years – as a serious competitor at a time when it needs much lower delivery costs to achieve greater earnings power.

“While recent stories and reports of a new entity competing with the three major carriers in the United States grabs headlines, the reality is it would be a daunting task, requiring tens of billions of dollars in capital and years to build sufficient scale and density to replicate existing networks like FedEx,” he said.

Doth he protest too much, I wondered.

Reality

Not only has Amazon both plenty of time and immense resources, but given its market-share-grabbing strategy worldwide – where vanity (revenues) is often preferred to sanity (net income) – the I would expect e-tailer to continue investing top dollar in its massive infrastructure expansion, without paying much attention to whether those assets will add precious basis points to its core profits over the short-term.

In this long-term game, you could well wonder if FedEx chief executive Fred Smith’s push to overpay for traditional logistics assets such as TNT Express in Europe was ever meant to be a real answer to Amazon boss Jeff Bezos’ plan.

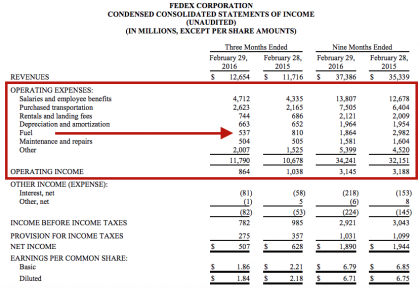

Margins are so important to FedEx that Mr Smith wasted no time at the beginning of the call to tell analysts how things look like across its divisions.

“Express segment margins in the current fourth fiscal quarter will be approximately 12%. Likewise, FedEx Ground, including SmartPost margins, will increase and be 16%-plus this quarter, while the FedEx Ground and supply chain segment will be 15%.”

Mr Smith also described it as “truly unfortunate” that Congress “did not increase the federal twin trailer limit from 28ft each to 33ft”, which would have benefited “consumers, lowered fuel consumption, and reduced highway accidents”.

“We are optimistic about FedEx Freight improving margins in the future,” he concluded.

It was helped by lower fuel prices, which fell over $300m quarterly in the nine months ended 29 February. However, salaries and purchased transportation costs, which together represent almost 60% of its total operating cost base, rose 9% and 17%, respectively, while reported revenue grew only 5.6% to $37.3bn.

Rising profitability, boosted by express, helped FedEx deliver the best daily performance on 17 March (+11.8%) on the stock exchange since the turn of the century, although it remains a possibility that Amazon will decide to pay less for FedEx’s services, despite FedEx playing down that threat – Mr Glenn noted that “other than the Postal Service, no single customer represents more than approximately 3% of revenue for FedEx Express, FedEx Ground, or FedEx Freight”.

Picking a fight

However, Amazon could want more of FedEx’s business – in fact, another way of interpreting Mr Glenn’s figures is that Amazon could take away 97% of FedEx’s revenue over time.

Amazon’s underlying margins are forecast at about 3-4% this year and next, against FedEx’s 10%, but FedEx needs growth and higher margins to continue to deliver value to investors, many of which have preferred UPS shares in recent times.

The problem for FedEx is that Amazon’s return on invested capital seldom justifies its cost of capital when it comes to new investment, but the tech behemoth is re-writing the books, proving that shareholder value can be delivered if cash balances are properly managed. With most online retailers using its web platform for sale and distribution purposes, Amazon operates like a bank in the way it manages working capital, which gives it a clear competitive advantage – and that shows in its financials.

At the end of 2015, Amazon had about $20bn of cash and cash-like securities versus $2.8bn of cash for FedEx – which, incidentally, experienced a drop of almost $1bn in its gross cash pile in the last nine months.

All these risk factors weighing on FedEx bring us to what Mr Smith had to say about the future challenges: “I should note there are three recurring areas of concern…one, future margins, two, industry disruption, and three, capital spending”.

Capex, in particular, is expected to rise to $4.8bn this year, up 2.8% on an annual basis from $3.5bn in the nine months ended 29 February, and $2.9bn in the comparable nine-month period in the prior year. But TNT Express, whose acquisition is expected to close later this year, could be a thorn in its side in that regard.

Surging fulfilment costs in the fourth quarter pushed down Amazon stock, and they are a key catalyst when it comes to value creation for a company that has grown aggressively well outside its comfort zone since inception. The more challenging, the better for Amazon – and it’s a strategy that has paid off. Since the stock market rally started in March 2009, its shares have risen almost 700% despite miniscule profits and widespread concerns in the investor community about returns and cost of capital.

So, is FedEx right to play down expectations surrounding Amazon in the logistics industry? If it’s not, then, it may also be overlooking Alibaba.

At a time when Mr Smith blames Congress for federal twin trailer limits, Amazon may be lobbying its way to becoming a delivery powerhouse, and I find myself half-agreeing with those who claim FedEx management is in a state of confusion, and those who say it is in full denial.

Frankly, I don’t know who is right, but with a market cap of $263bn, I think Amazon could easily buy FedEx in a flash if it wanted to, and break it up while retaining the bits and bobs and aircraft it needs. That, at least, would justify bullish analysts’ targets for its shares.

Read more

To learn more about FedEx’s third-quarter results for the period ending 29 February, please click here and here.

To learn more about what FedEx management had to say on the call, please click here.

No comments:

Post a Comment