Mobile E-Commerce Hits All-Time Record High

Mobile commerce continues to grow at an astounding rate. It's only a matter of time until mobile orders represent the majority of online commerce. By Kyle Shepherd

0

July 15, 2014

Mobile computing is doing everything except slowing down.According to the new Custora E-Commerce Pulse Mobile Report, in the past four years the percentage of traffic to e-commerce sites from mobile devices (phones and tablets) jumped from 3% to nearly 37%, while US mobile e-commerce sales grew from $2 billion in 2010 to $43 billion in 2013.

This significant industry shift has important implications for marketers who are working feverishly to revise their strategies in order to reach consumers when and where they want to be reached.

The report shows that, while the majority of e-commerce spending still occurs on PCs, mobile’s share is growing significantly faster.

The Custora E-Commerce Pulse Mobile Report analyzed data from more than 100 retailers, 70 million consumers and $10B in transaction revenue to gain a deeper level of understanding into which mobile e-commerce trends marketers should pay the closest attention to.

The report also includes interviews with marketing leaders at online retailers excelling in mobile e-commerce - Nomorerack, Karmaloop, and thredUP - who share practical advice from the front lines.

Here are some of the report’s findings

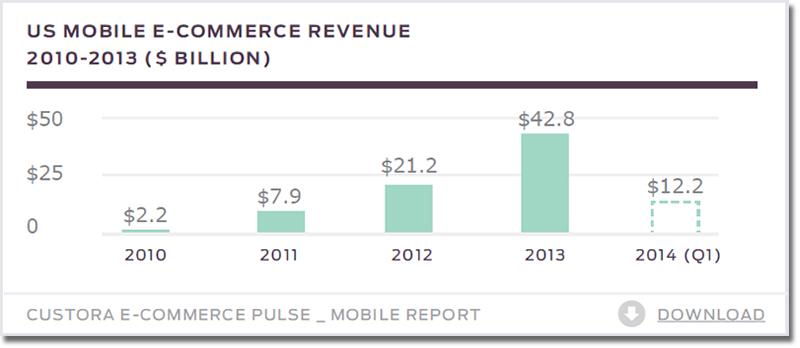

1. US Mobile E-Commerce is a $40 Billion Market, Poised to Hit $50 Billion in Sales in 2014

In the past four years, the mobile e-commerce market grew 19-fold: From $2.2 billion in 2010 to $42.8 billion in 2013. This represents 1875% growth over these four years, and 111% 4-year CAGR (Compound Annual Growth Rate).

2014 is off to a strong start with $12.2B in mobile e-commerce sales in Q1 alone. It is likely that mobile e-commerce will hit $50B in sales in 2014.

Note: These estimates are based on US Department of Commerce figures for total US e-commerce revenue, 2010-2013, and Custora’s estimates for the share of mobile e-commerce.

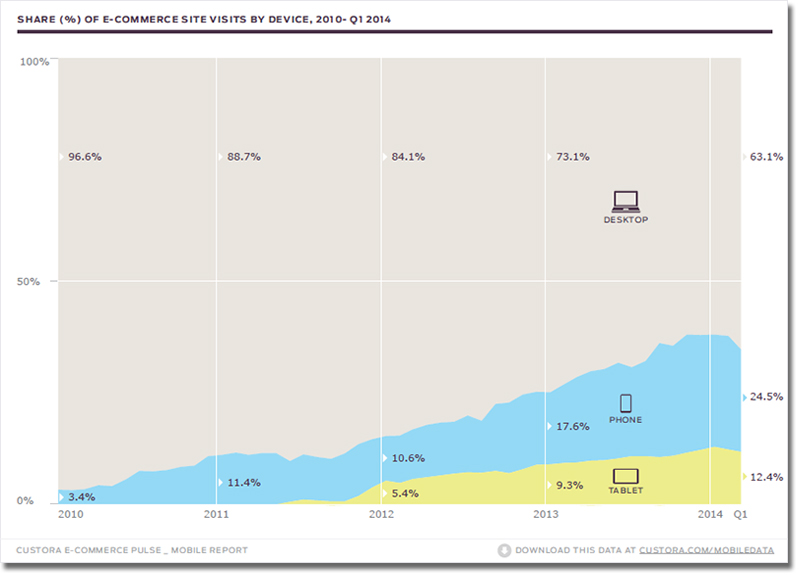

2. More Than a Third of Visits to Online Stores Now Come From Mobile Devices (phones and tablets)

By the end of Q1 2014, 36.9% of visits to online stores came from mobile devices. That’s up from 3.4% at the beginning of 2010.

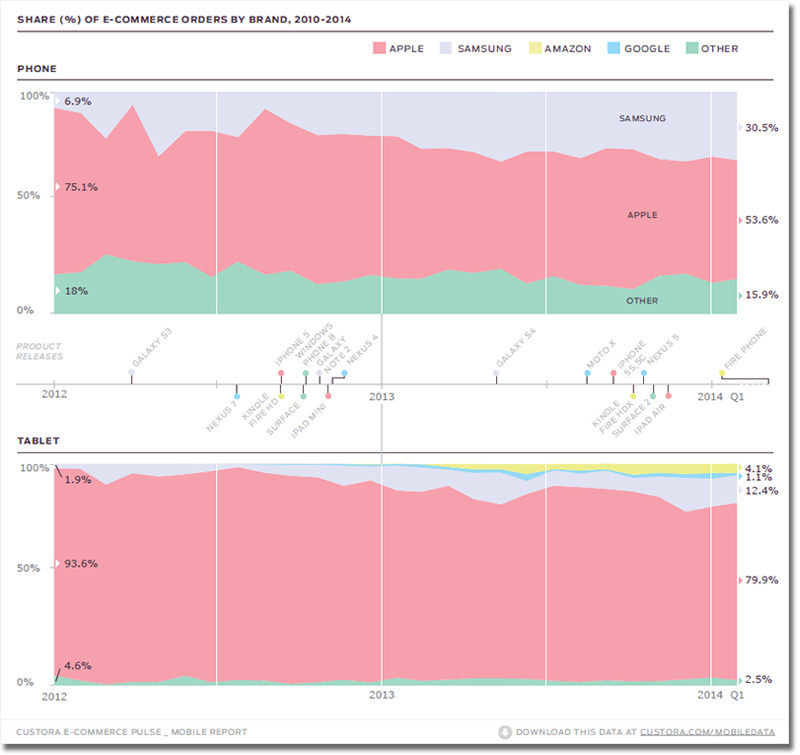

3. Apple Dominates E-Commerce For Now

Apple’s mobile supremacy remains but continues to be challenged, most notably by Samsung and more recently, Amazon.

Over the last two years, iPhone’s share of e-commerce orders done on mobile phones went down from 75.1% in 2012 to 50.6% in Q1 2014. Samsung phones have more than quadrupled their share of phone orders over the same time period — growing from 6.9% in 2012 to 30.5% in 2014.

iPad still accounts for the biggest share of tablet e-commerce orders, though the share of orders made from Samsung tablets increased from 1.9% in 2012 to 15.3% in Q1 2014. Amazon has also quickly become a player, with purchases made on Kindle Fire tablets now accounting for 4.5% of all tablet orders. This bodes well for the just-announced Amazon Fire Phone – we’ll check back in on that as numbers start to come in.

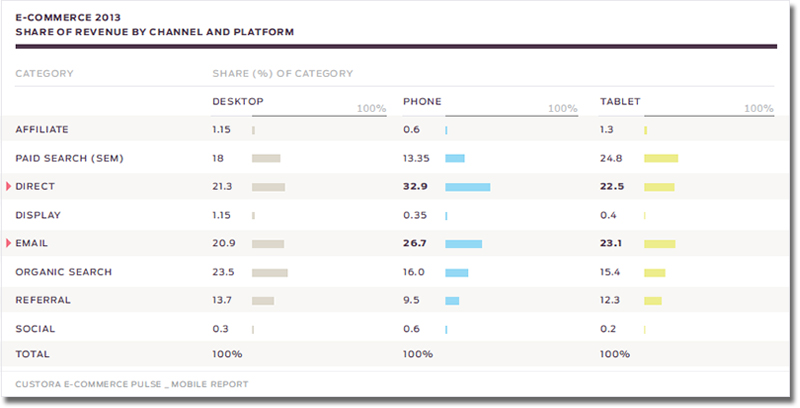

4. Email Marketing Drives Mobile Purchases – Social Media Doesn’t

Customers responding to email marketing and shoppers going directly to e-commerce sites (including app traffic) accounted for the highest share of purchases on phones. Email marketing generated 26.7% of sales on mobile phones, compared to only 20.9% on desktop, and 23.1% on tablet.

Social media accounted for only 0.6% of sales on phones and 0.2% on tablets.

“Retail is changing, and cross-device shopping is at the heart of the change. High-value, repeat customers are now three times more likely to be cross-device shoppers than they were in early 2012. The fastest-growing retail brands segment their customer base, and know that different customer segments have unique device preferences, which often translate to varied product category preferences, and specific purchasing patterns,” said Corey Pierson, CEO of Custora.

“Mobile commerce continues to grow at an astounding rate. It’s only a matter of time until mobile orders represent the majority of online commerce. Meanwhile, as mobile is growing, the landscape is dramatically changing. Mobile shopping used to be synonymous with Apple, but that’s no longer the case. Samsung is truly making a dent in mobile shopping, and Amazon Fire is growing quickly.”

No comments:

Post a Comment